Benefits for Customers and Manufacturers of new innovative Forms of Leasing

Continuous developments in the world of trade and finance, increased competition and rapid technological progress are changing the needs of customers in the capital goods sector. Companies that want to remain competitive in the long term must make their production more flexible, optimise processes and costs and at the same time keep up with the latest technological developments. Leasing as a form of financing offers companies this flexibility.

From purchase to utilisation

Increasingly, companies are looking to lease equipment rather than buy it, and return it to the manufacturer after a certain period of use. The great advantage of leasing as a form of financing is its flexibility from the customer’s point of view. It is particularly suitable for companies that want to keep their production equipment up to date, optimise liquidity and avoid tying up capital.

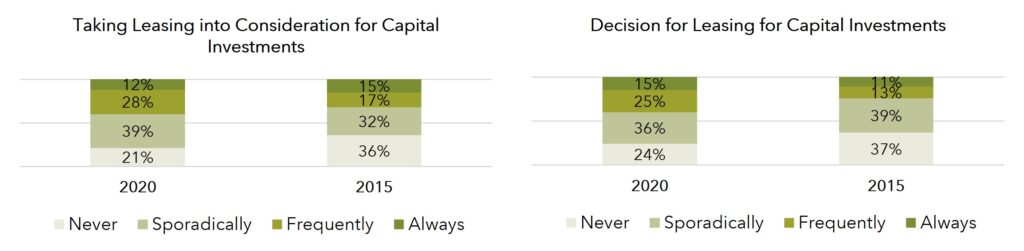

This trend is shown by the latest market study conducted by the German Leasing Association (BDL) in 2020.1 79% of companies in Germany now consider leasing when making investment decisions (see figures below). In 2015, the figure was 64%. Specifically, three out of four companies decide to realise their investment projects using leasing. According to the survey, the main arguments in favour of leasing are the ability to return the asset at the end of the lease term and the predictability of costs. However, additional services (e.g. maintenance) have also become more important.

New innovative forms of leasing

Flexibility is also an important factor in the current leasing trends towards even more customised leasing financing solutions tailored to the needs of the company:

1. Seasonal and progressive leasing rates

In these leasing models, companies pay the leasing instalments when they generate turnover or when the leased asset generates income. Seasonal leasing instalments are common in the construction, tourism and agricultural sectors, for example. Mountain railway operators adjust the leasing instalments to the winter season, agricultural businesses to the harvest season. With progressive leasing models, the instalments increase gradually. This gives companies enough time to start up the new equipment and gradually ramp up production.

2. Pay per Use

The Industrial Internet of Things (IIoT)2 has created the basis for the pay-per-use business model. Lessees only pay for the actual use of the leased equipment, for example a variable leasing rate linked to the number of units produced by a machine. The lessee only pays when the machine is in use. With the pay-per-use model, there is no need for a large initial investment point of view customer and the associated capital commitment is eliminated. Instead, thanks to pay-per-use, the costs (incl lease rates) always rise and fall with the current capacity utilisation of the leased equipment.

Examples of pay-per-use financing options include:

- Lease rates according to utilisation time (machine running time)

- Lease rates according to quantity produced (number of units produced)

- Lease rates according to unit of consumption (e.g. per km)

According to the Swiss Leasing Association (SLV), based on a survey of 103 machine manufacturers in the DACH region in 20213, 98% of these manufacturers are prepared to offer pay-per-use as a form of financing. More than a quarter of the companies surveyed already use pay-per-use.

3. Servitization

Leasing is not only becoming increasingly flexible, it is also becoming more comprehensive. The term servitisation refers to leasing solutions for capital goods that not only include financing, but also additional services such as maintenance and service (incl. availability guarantee for the leased asset/equipment), technical support, spare parts delivery and insurance. The customer receives an «all-round carefree package». Financial risks (e.g. the failure of a machine) are partially or completely outsourced to the supplier and fixed costs are transformed into variable costs based on the utilisation of the asset/equipment.

From the manufacturer’s perspective, servitisation requires a change in the business model and corporate culture. It requires companies to adopt the customer’s perspective, analyse the customer’s service needs in detail, and ultimately move from a short-term, product-oriented sales business to a long-term service-oriented relationship business.

Tapping into new customer segments with innovative leasing solutions

The manufacturer’s motivation for offering flexible, innovative leasing solutions is to differentiate itself from its competitors, thereby expanding its sales market and tapping into additional customer segments, as, for example, thanks to customised lease financing, the investment object is also suitable for less financially strong customers or for companies with fluctuating order books/demand or for companies with small production volumes. Furthermore, the manufacturer can build up a «second-hand machine park» over time. Returned machines can be leased on to a third-party customer at the end of the lease term or sold at an attractive residual market value. The manufacturer can use the second-hand market to tap into an additional customer segment that may not be able to afford a new machine. Combining leasing with other services such as maintenance and spare parts service offers additional revenue potential for the manufacturer. Leasing via a separate leasing vehicle (SPV) ensures that assets are of-balance sheet of the manufacturer and the manufacturer can recognize revenues from the sale of the leased equipment.

AIL’s experience in leasing

With its many years of experience and proven track record in the financing of capital goods, AIL can provide targeted support in the conceptualisation and structuring of such innovative leasing financing solutions.

Potential AIL services on behalf of the manufacturer include:

- Conception and development of tailor-made leasing solutions (incl refinancing of Leaseportfolio)

- Build of financial business case and lease rate calculator

- Preparation of necessary documentation (project description, presentation, etc.) for implementation of relevant leasing solution

- Identification of suitable financing partners

- Coordination of the financing process

- Support in the negotiation of the financing documentation

- Advising generally on structuring, negotiating and implementing of the leasing solution (incl establishment of leasing vehicle acting as lessor)

- Management of the leasing vehicle (bookkeeping, invoicing, lease rate calculation, reporting, compliance and regulatory tasks, preparation of financial statements, etc.)

1 Market Study – Leasing in Germany 2020, Bundesverband Deutscher Leasing-Unternehmen (BDL); survey based on interviews with 750 German companies of different sizes

2 The Industrial Internet of Things (IIoT) refers to interconnected sensors, instruments and other devices that are networked with the computers of industrial applications. This connectivity allows for data collection, exchange and analysis, facilitating improvements in productivity and efficiency.

3 Kaufmann Langhans Strategieberatung GmbH: Pay-per-use im Maschinen- und Anlagenbau (2022)